When Traditional Brokers Set Their Sights on Crypto Trading

“Lately, I’ve been on calls every night until 2 a.m.”

The man who said this is a seasoned finance professional with more than a decade in traditional brokerages. He said it while laying his phone face-down on the coffee table. The corners of his eyes were tinged red, yet his tone was nonchalant.

His Beijing office sits in a siheyuan in Xicheng District. The paint is peeling on its double doors, afternoon sunlight slants into the courtyard, catching motes of dust in its beams. Seated at an old wooden desk, he’s juggling regulatory, partnership, and project scheduling issues.

After more than ten years in finance—having weathered a previous financial crisis and built global experience across funds, products, and teams on nearly every continent—he recently shifted focus. Now, he’s diving into a direction most traditional finance professionals once considered outlandish: virtual assets.

Traditional finance’s attention to Web3 didn’t begin in 2025. If you trace the roots, many point to Robinhood.

This “zero-commission stock trading” platform added Bitcoin and Ethereum trading back in 2018. At first, it was just a product extension—users could buy crypto like Tesla stock, with no wallet or blockchain expertise needed. The feature wasn’t widely advertised in its debut year, but a few years later, it became a growth catalyst.

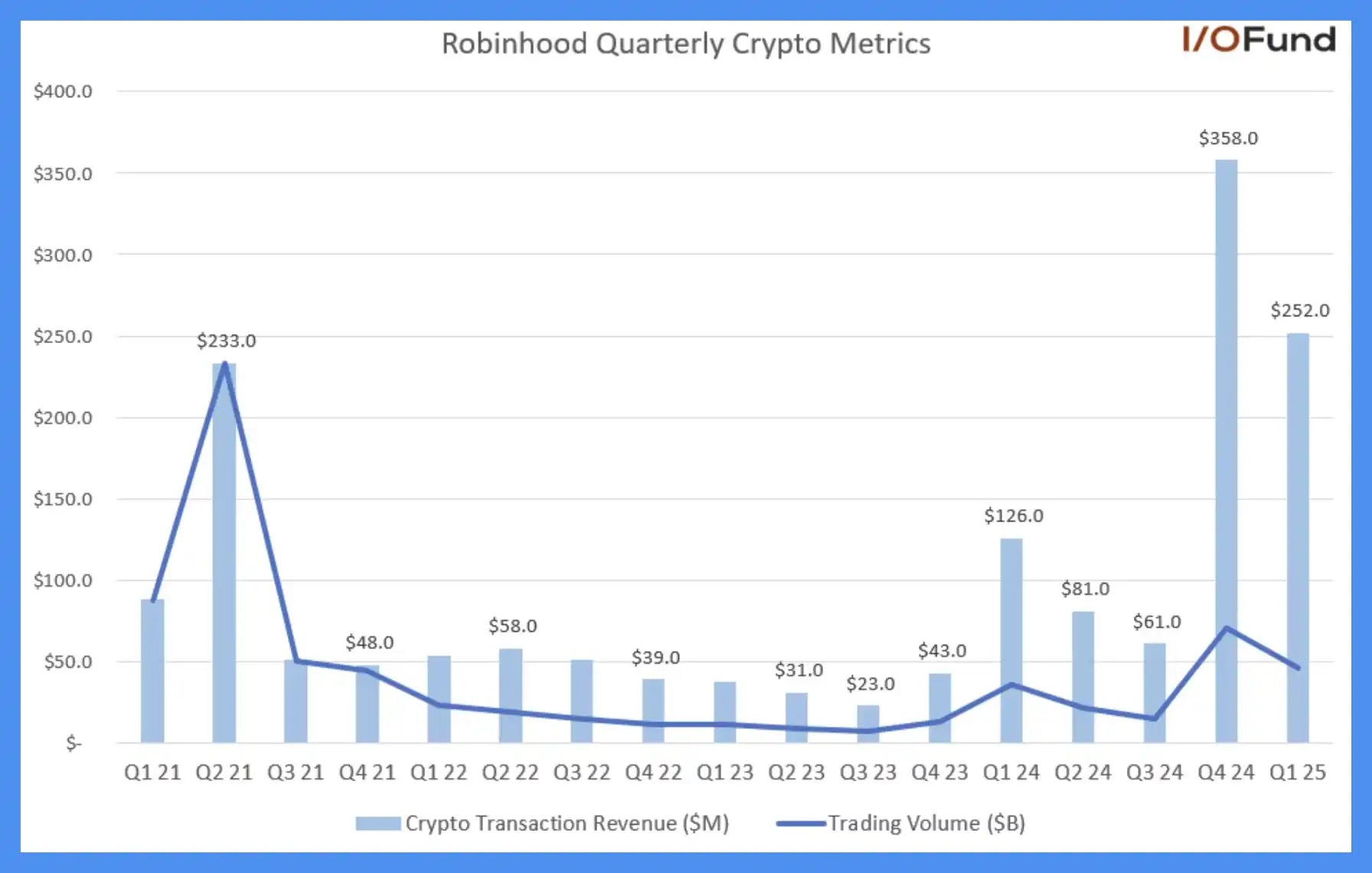

In Q4 last year, crypto made up over 35% of Robinhood’s total net revenue. Trading volume soared 455%, driving a 733% year-over-year jump in trading revenue to $358 million—making crypto Robinhood’s top revenue source for the quarter. In Q1 2025, crypto contributed over 27% of total revenue, with trading revenue doubling to $252 million year-over-year.

Robinhood Quarterly Crypto Asset Trends. Source: IO.FUND

This transformation wasn’t driven by technology, but by millions of users clicking to trade. Robinhood never pushed a Web3 narrative; it simply aligned with users’ trading habits. Crypto trading evolved from a fringe product to the company’s central engine for growth.

Robinhood has since transitioned from a mainstream brokerage to a digital asset platform.

After Robinhood set the example, 2025 saw traditional financial institutions move beyond merely watching crypto—they entered the market in force. Their goal is not just to “try out” Web3 or pick projects. “Traditional finance will take over the crypto industry within a decade.”

This reshaping of crypto’s core by legacy brokerages is already underway.

In March 2025, Charles Schwab—one of the world’s largest retail brokerages with over $10 trillion under management—announced it would offer spot Bitcoin trading within a year.

In May 2025, Morgan Stanley, one of Wall Street’s most influential investment banks, announced it would add BTC and ETH to its E*Trade platform, giving retail clients direct access to crypto.

In May 2025, JPMorgan Chase—America’s largest bank by assets and long a crypto skeptic—announced it would allow customers to buy Bitcoin.

In July 2025, Standard Chartered—a veteran British bank with deep roots in Asia, the Middle East, and Africa—said it would offer spot BTC and ETH trading to institutional clients.

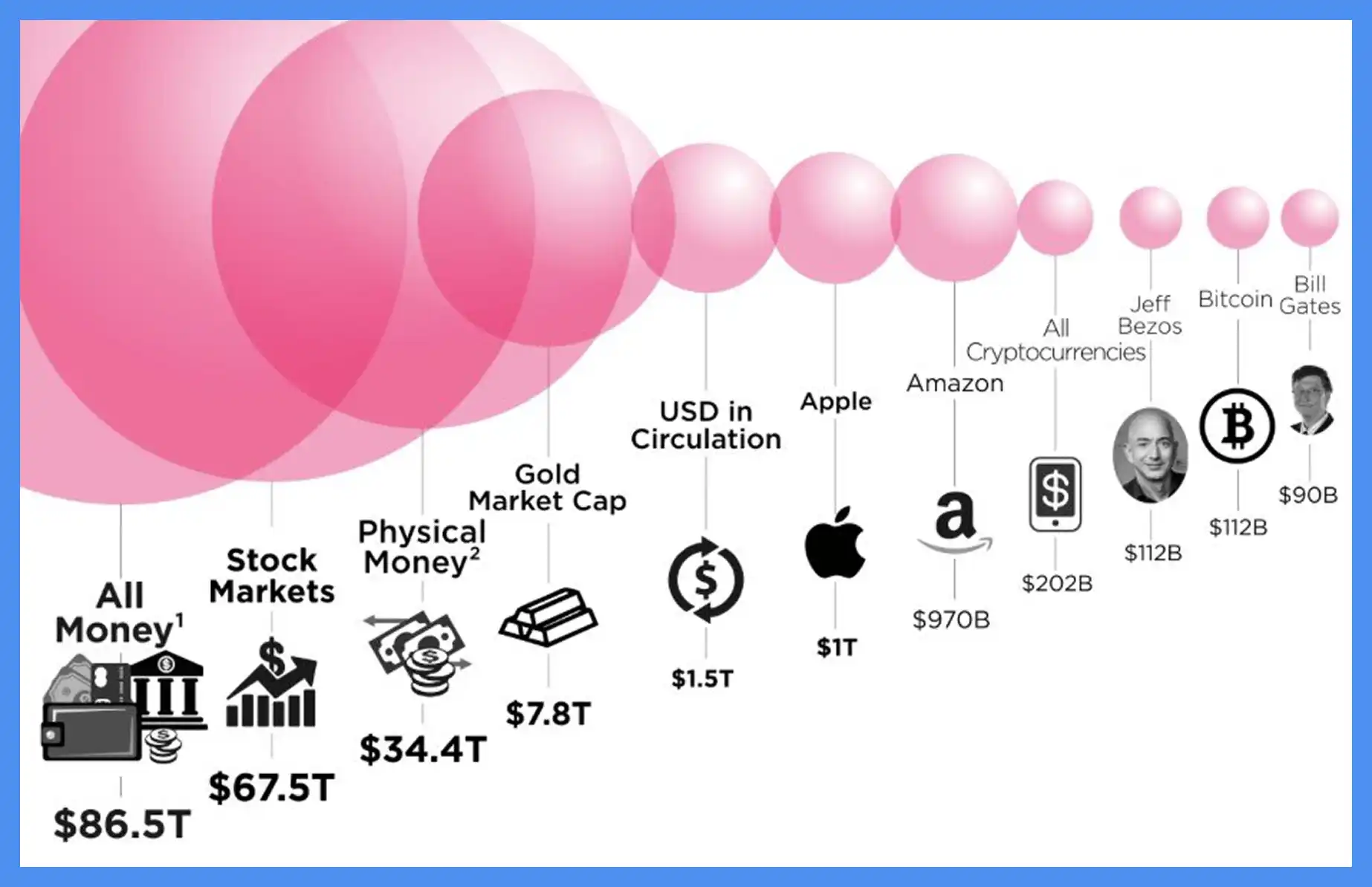

These financial giants control the global movement of capital: money transfer channels, clearing networks, fiat payment rails. Collectively, they hold tens of trillions of dollars in assets—while the total crypto market cap now stands at just $4 trillion.

Major Asset Market Capitalization Rankings. Source: Steemit Community

These institutions are building their crypto presence around traditional compliance frameworks. When an institution possesses regulatory trust, user scale, and settlement capabilities, it has everything needed to construct a crypto trading network.

In finance, whoever controls account onboarding controls money flows, customer relationships, even pricing power. Crypto exchanges once set the narrative with token listings and handled liquidity through fiat onramps. But after dominating as the industry’s main gateway for nearly a decade, that “asset entry” role is now slowly being reclaimed by traditional finance.

“Crypto exchanges should start feeling anxious.”

He remained poised, with no trace of schadenfreude. The root of the anxiety is not just new entrants or policy updates, but an industry-wide awakening: crypto platforms may no longer be the only dealer at the table.

How to Stay in the Game

An insider at one crypto exchange told us he’s now answering messages as late as 5 a.m.—negotiating partnerships by day, tracking progress at night, monitoring community feedback at all hours, running on little sleep.

“We can only survive by staying anxious.”

The anxiety is about platform competition—the daily grind for users, products, and volume.

The struggle comes from both limited industry growth and mounting external pressure.

Traditional finance is eroding the core strengths that crypto exchanges depend on—from fiat deposits and custody, to user onboarding and spot trading. Backed by regulatory licenses and millions of users, they’re storming in and clearly don’t aim to coexist with crypto-native players.

Most crypto exchanges immediately launched tokenized stock products. Now you can buy Apple with USDT, use leverage on Nvidia, and trade Tesla through on-chain contracts. Tokenizing traditional assets has rolled out across platforms as a shared industry response.

Bybit was first to act, launching tokenized US equities after just two months of development and partnership-building with XStocks—the rollout was swift.

Bybit still sees key advantages for centralized exchanges: real users, deep liquidity, and robust trading depth—assets brokerage newcomers can’t quickly replicate.

The new tokenized equity products fill clear gaps: after-hours trading, or users blocked from traditional markets by geography or compliance. Crypto’s 24/7 nature unlocks new liquidity for legacy assets.

Still, this isn’t guaranteed victory. Bybit’s head of spot, Emily, admits U.S. equity tokens are just getting started—participation and hype are far below that of major new coin launches.

She’s still optimistic, since this marks Crypto expanding its innovation into TradFi’s domain. DeFi, synthetic assets, and on-chain staking are creating new possibilities for traditional assets; the real value may lie there.

But while these new features look proactive, in the eyes of many, they feel defensive.

As exchanges lose dominance over asset onboarding, they try to appear globally connected. Tokenized stocks have become the go-to defensive play.

But tokenized equities are not a new idea.

In 2020, FTX introduced tokenized stocks—TSLA/BTC, AAPL/USDT, and more—challenging traditional pricing logic.

That was crypto’s offensive era. FTX wanted crypto finance to rewrite trading on Wall Street, to price Nasdaq stocks with crypto markets.

Maybe FTX already saw brokerages as their future primary rival, so they struck early. In hindsight, the model is back, but its spirit has changed. After FTX’s collapse, tokenized stocks feel like a tourniquet instead of a battering ram.

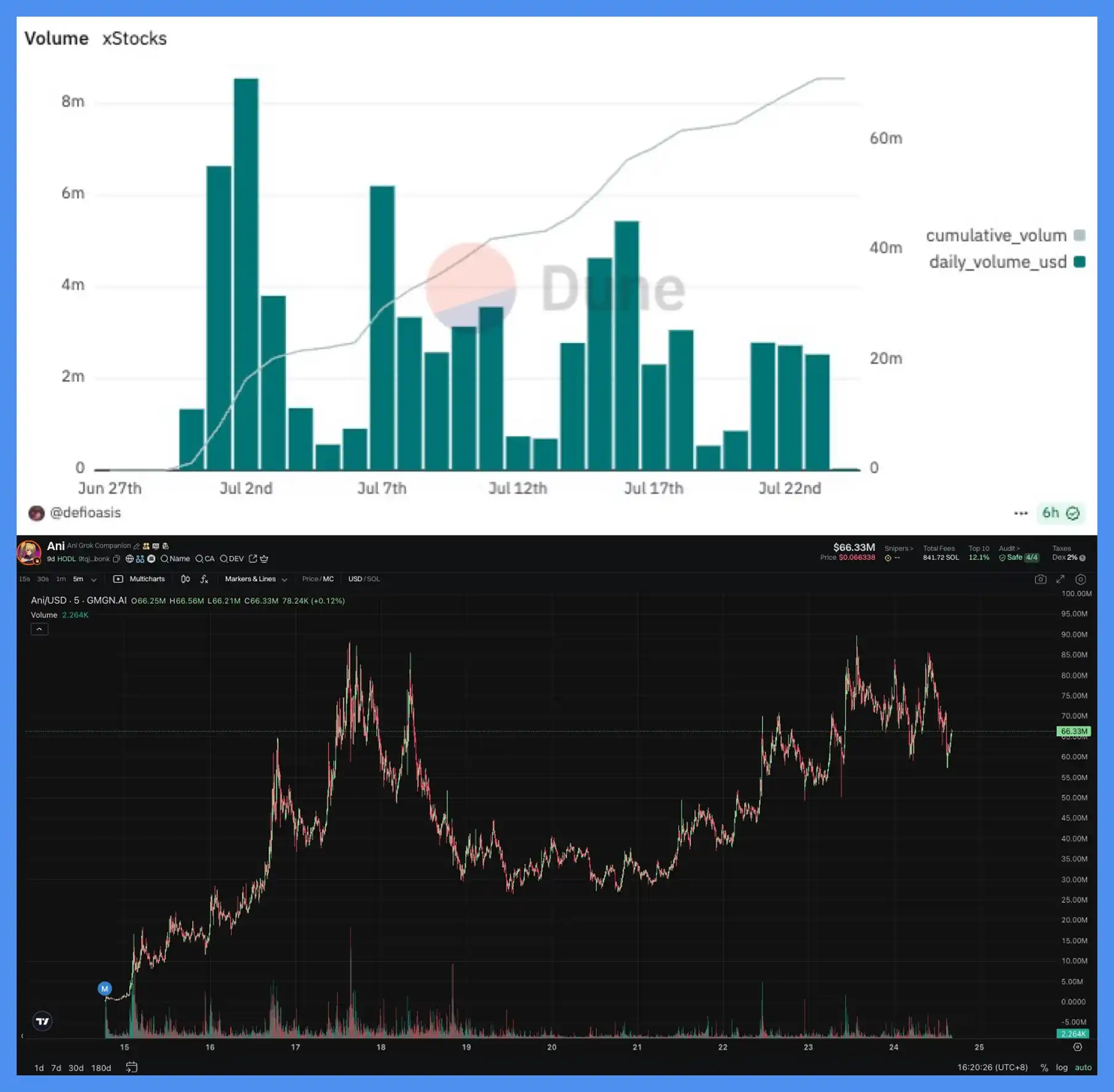

The data bears this out.

Tokenized equity trading generated initial buzz, but engagement soon faded—no platform saw a real breakthrough.

Meanwhile, at the same time, Solana’s memecoin scene took off in a totally different direction. A single Musk tweet could push meme coin market caps to hundreds of millions, with daily volumes in the tens of millions—often eclipsing a full week’s tokenized stock activity.

Top: XStocks trading volume, Source: Dune; Bottom: Meme coin Ani trading volume, Source: gmgn

New offerings, but no new users.

At this stage, it doesn’t matter what features CEXs launch. What matters is why—and whether these features can help reestablish the role they’re steadily losing.

This wave of tokenized stock launches isn’t about industry progress—it’s about nobody daring to stand still and do nothing.

Kant said, “Freedom is not the ability to do whatever you want, but the ability to refrain from what you do not want.”

Compliance Is Only an Illusion

Recently, nearly every crypto exchange has been touting compliance—applying for licenses, restructuring, hiring traditional finance execs, trying to prove they’ve left the “wild west” behind to become legitimate, regulated institutions.

This is both industry consensus and collective anxiety.

But to professionals from legacy finance, this version of “compliance” is far too thin.

“A lot of platforms get licenses from small jurisdictions to claim compliance, but those licenses aren’t worth much—they don’t get you in the real game,” he says, matter-of-factly.

Being “at the table” means more than holding a business license. It means access to the real financial system—major bank accounts, global settlement networks, regulatory trust, and true institutional partnerships.

The reality is, the crypto industry has never been seen as an equal by traditional finance.

Traditional finance operates on chains of responsibility and closed trust loops: transparent client structures, risk control, auditability, and traceable funds. Crypto exchanges, by contrast, were born in regulatory cracks—enjoying high profits and growth, but rarely building real compliance infrastructure.

The industry gets it. No one cared when there was no competition. But now, as legacy institutions arrive and play by their rules, crypto’s “industry norms” quickly become vulnerabilities.

Some platforms are making real adjustments—adding compliance audits, establishing offshore trust structures, splitting business lines—to appear more credible.

Still, many regulators aren’t buying it. They may go through the motions, but never really see you as part of the system. No matter how close you look, it doesn’t mean they’ll let you stay.

Yet not all platforms are just going through the motions. Bybit is among the few that’s broken through regulatory barriers—this year, they were among the first to secure a European MiCA license and opened a European headquarters in Vienna.

Bybit concedes this path is tough and doesn’t hide from regulatory skepticism. As Emily says, regulators are no longer in the dark about crypto; they’re beginning to understand the industry’s business models and technologies. Their knowledge and willingness to work with crypto are deepening.

Bitget’s Greater China head, Jack Xie, told us Bitget has obtained virtual asset licenses in multiple countries and built local compliance frameworks to fit each region’s rules. The team is also pursuing a MiCA license, aiming for stable access to Europe and to lay the groundwork for seamless cross-border operations under unified regulation.

Still, such examples remain rare. Most platforms lack credentials, networks, and trust within legacy finance—and the old high-growth advantages of regulatory gray zones are disappearing. Compliance transformations are hard; returning to crypto-native business puts them in the crosshairs of aggressive new rivals.

So, the industry keeps chasing compliance: getting licenses, restructuring, running regulatory processes. Often, these moves are less about strategy and more about being driven by anxiety.

Intermission: The Midgame

At 5 a.m., Bitget’s Jack Xie is still replying to community questions: how to trade tokenized equities, the latest compliance progress, or what’s happening with PUMP subscriptions. He and his team routinely work through the night—an all-nighter is nothing unusual.

On a hot afternoon in Beijing, in a courtyard house, a Hong Kong brokerage exec sips tea and negotiates deals with C-suite leaders from listed companies. Behind a carved wooden door is a courtyard paved in gray brick, shaded by trees and filled with the sounds of cicadas.

Further west, in Vienna, Bybit has just opened its new European headquarters after landing a MiCA license—a new foothold for centralized exchanges in Europe, while most peers are still feeling their way forward.

In different places, at different tempos and emotional states, they echo one another: “Change is too fast,” “Let’s take it slow,” “How do we keep moving forward?”

But the foundation for moving forward isn’t what it was a few years ago.

Crypto exchanges may no longer sit at the heart of the narrative or as the prime hub for capital. They now stand at the edge of a new order, being slowly pushed out of the center by invisible rules.

Complex new rules and bigger capital are steadily replacing the old crypto-native narratives and structures.

Crypto exchanges persist—new features roll out, announcements go live—but their communication, rhythm, and context are all shifting. Everything is in flux.

Some changes are intentional, some are forced, but in most cases these platforms are just trying to keep a foothold in a rapidly evolving era.

Still, not everyone is pessimistic. Both Jack Xie and Emily believe crypto’s impact on traditional finance far outweighs TradFi’s pressure on CEXs. They welcome institutions from traditional finance, arguing that every wave of evolution needs new players. Centralized exchanges are now expanding institutional business, wealth management, and asset allocation. The two financial worlds are starting to merge—“it’s a romantic moment.”

Yet everyone knows these advantages don’t erase anxiety.

Many questions have no clear answers: Will regulators ever truly open the doors to crypto exchanges? Will traditional finance genuinely collaborate, or will it just replace them?

And perhaps most crucially—will platforms have another chance to define themselves before the next major narrative arrives?

No one claims certainty. Everyone just keeps at their daily grind—meetings, product tweaks, licensing, feedback loops—holding on, and waiting for a chance to take the initiative again.

All while waiting for the next big reshuffling of the industry.

Disclaimer:

- This article was republished from [BLOCKBEATS], with copyright belonging to the original authors [Peggy, Kaori, Sleepy]. For reprint concerns, please contact the Gate Learn team. We will address any issues promptly according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the authors and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is expressly mentioned, these translations may not be copied, distributed, or plagiarized.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge