Tokens Are More Than Just Customer Acquisition Costs: They Serve as Tools for Evaluating User Behavior

This article explores the role of tokens as underwriting tools for user behavior in the crypto space, and analyzes airdrop mining, token incentive design, and how gamifying and financializing user behavior can drive effective user acquisition and retention.You have some errors, warnings, or alerts. If you are using reckless mode, turn it off to see useful information and inline alerts.

Most founders think of CAC as an accounting metric. In crypto, especially for apps or protocols that require frequent user interaction, it’s closer to structured finance. Tokens aren’t just incentives; they’re underwriting instruments.

They embed optionality into user behavior, transforming growth spend from a sunk cost into a portfolio of contingent claims on future participation. When you emit a token, you’re not “rewarding” a user: you’re effectively writing a behavioral derivative.

Traditional CAC is cash out the door. Token CAC is exposure with convex payoff, endogenous pricing, and reflexive momentum. This isn’t marketing. It’s capital formation, abstracted to the user level. Getting this right is instrumental in generating upward momentum across acquisition, retention, and mindshare.

There’s a reason why people like @nikitabier are getting more involved in crypto. Crypto is one of the last frontiers, outside of agent development, where there’s real innovation in growth and distribution engineering.

Airdrop Farming: The Premature Yield Curve

Airdrop farming is often misunderstood. Yes, it’s extractive. Yes, it’s often gamed. But beneath the mercenary surface lies a deeper truth: users are expressing forward-looking expectations of token value, and pricing their time accordingly. It’s not behavior-for-reward. It’s behavior-as-option-exercise.

Early airdrops created primitive behavior markets. A lot of us, myself included, got started in DeFi based on the expectation of future rewards through farming.

Speculators front-ran protocol generosity by simulating conviction. Protocols, in turn, tolerated the leakage, because even noisy activity created liquidity, distribution, and narrative scaffolding. That attention capture ultimately helped price discovery.

Farming wasn’t a hack. It was the first market to price attention futures. And ultimately, crypto is a venue for trading and financializing attention.

CAC as Structured Exposure

In traditional growth models, CAC is a constant. In crypto, it’s a curve that is sculpted through emissions, vesting, decay, and game mechanics.

You can think of each user as a tranche of exposure:

Early adopters = high risk, high leverage.

Power users = steady cashflow, lower variance.

Referrers = distribution agents with embedded network delta.

Tokens allow you to price these tranches dynamically, not just in dollars, but in protocol-native instruments that appreciate reflexively as the network scales. It’s not “paying users.” It’s writing call options on your future traction and distributing them to those who generate it.

Incentive Design: Fractal Convexity

Well-designed token systems create layered convexity:

- You’re rewarded for acting early.

- You’re rewarded again if others act because you did.

- You’re rewarded a third time if the system itself reprices upward as a result.

Some of the most fun systems in crypto leaned into those mechanics to create natural Schelling points: reflexivity through onchain activity. Just 3;3 bro.

And everybody knows the payoff isn’t linear. It’s recursive. This creates fractal convexity where each unit of effort generates second and third-order exposure to protocol success.

Effective incentive design encodes this into the system:

- Points systems as both soft warrants and volatility surfaces.

- Vesting schedules as synthetic locks.

- Differently gradated costs of action (in terms of underwriting) to appeal to different user personas, investors included.

You’re not offering certainty. You’re offering exposure to potential. That’s what makes it spread.

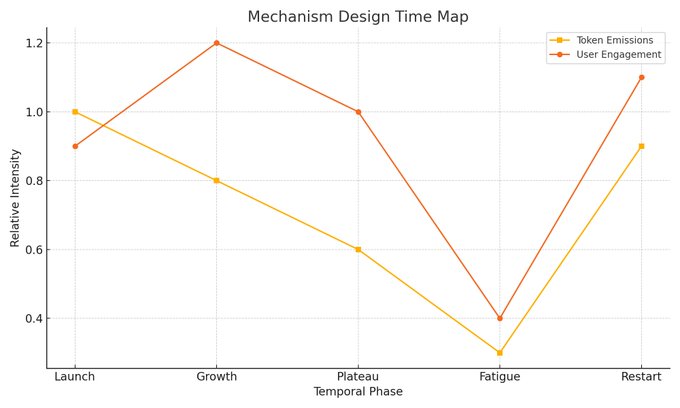

Mechanism Design: Tempo, Reflexivity, Pacing

Traditional CAC is static. Tokens let you control tempo. Time-based unlocks. Seasonal emissions. Expiring multipliers. These all shape behavioral density, which the frequency and intensity of user engagement.

Well-designed CAC systems balance:

Reflexivity (users price their own behavior),

Scarcity (earning windows close),

Narrative (progress is shareable),

Volatility (outcomes are uncertain, but non-zero).

In crypto, referral isn’t affiliate marketing, memetic underwriting. Users become CAC agents, compensated not for reach, but for reflexivity: their ability to bring in others who also want exposure.

This turns virality from a coefficient (k-factor) into a financial feedback loop:

- Invite → points → clout → attention → price appreciation → more invites.

It adds stakes to distribution. Incentivized action with social reach becomes self-pricing narrative velocity.

Tokens are CAC with tempo. Hence the adage: “the tech is good when the price goes up.” If reflexivity is sustained, crypto-native network effects can outlast many traditional virality flywheels.

Hyperliquid.

Blur and Blast: Mechanized Liquidity Extraction

@blur_io executed CAC-as-instrument with surgical precision.

Points weren’t loyalty badges. They were emissions futures, leaderboard-based and time-weighted. Every user became a micro-market maker competing under decaying incentive curves.

The leaderboard wasn’t just gamification. It was onchain price discovery of who could trade the hardest under pressure. We can blame Blur for imploding the NFT market, and maybe even NFT finance as a whole. Fractal convexity meant all assets, all collections, and all actions became tightly correlated.

But that system did exactly what @PacmanBlur intended: aggressively corner the market.

Deep liquidity. No CAC burn. Perfect information asymmetry. It wasn’t marketing. It was a structured auction for liquidity and attention.

Blast pushed it further — CAC wasn’t just a cost. It became a metagame.

The early Blast era was one of the most fun periods in crypto for many dApp users. It leaned hard into underwriting user behavior and financializing that underwriting explicitly. OTC markets formed around Blast Gold and Points. Teams competed for flows by shipping and capturing attention. The metagame was multi-actor, zero-sum, and speculative by design.

A lot has been said about what the Blast team did right and what they did not, but it’s obvious to everyone that the Blast system has had a significant impact on the design space for token incentives. The rules were explicit, speculation was embraced, and new markets were created around the future value of user behavior that was being underwritten on a periodic and systematic basis.

Abstract: Gamifying User Behavior Underwriting

Speculative games with incomplete information are inherently convex. Pre-TGE, speculative velocity reduces as more clarity is obtained. The spread between hope and reality tightens as a system approaches the TGE event horizon. Something that any power user of Blast would have viscerally experienced in May / June. As such, smart teams are taking inspiration elsewhere.

@AbstractChain incentive design is less explictly financialized than Blast, but the velocity for speculative interested is fuelled through taking a few lessons from game design. Most crypto users and intimately familiar with the reward systems that exist in gaming - achievments, statuses, titles, gear etc.

Abstract is positioned as an accessible general-purpose L2 for consumer crypto applications. It only makes sense that the Abstract Portal would lead into explicit gamification of onchain interactions, while still underwriting user behavior via XP farming, though far less explicitly. Based on what I am observing, their approach is proving to be sustainable.

While there is less variance and narrative-generation focused on the future token price, there is strong user acquisition velocity and real, organic usage of apps. The use of badges and forms of achievements that can be unlocked to fuel a dopaminergic loop for users and farmers creates an intermediate stage between an incentive campaign and TGE - enabling the chain team and core builders to not be in a rush to launch a token and to funnel enough users into the chain to sustain organic PMF.

The Fat App Thesis: CAC Becomes the Balance Sheet

The Fat Protocol Thesis said infra would capture value. That may still be true, but the CAC primitives here suggest something else:

The app is the balance sheet. These aren’t just products — they’re synthetic economies, with their own currencies, emissions, and belief markets. Blur. friend.tech. Blast. Each one engineered CAC systems that bootstrapped liquidity, distribution, and narrative in parallel.

CAC isn’t a cost. It’s a tokenized underwriting model for growth. The token is synthetic equity.

CAC Is Now a Financial Surface

In crypto, CAC isn’t something you lower. It’s something you price. You don’t spend to acquire users. You write instruments that expose them to the upside of their own behavior.

That’s why the best crypto growth engines feel more like games, hedge funds, or cultural movements than startups. They’re systems designed to:

Games that underwrite attention

Financial surfaces that generate reflexivity

Growth engines that look like structured products

While, to an extent, I still believe that onboarding is a meme, and some of the most successful protocols in the space are relatively insular, I think we are approaching an inflection point where through gamification, a non-native user will be able to experience the benefits of a protocol or product underwriting their behavior and thus will be able to see the benefits of having a financial metagame.

Onboarding is a meme because tourists want to build non-speculative crypto use cases. Crypto, on a consumer level, is pure speculation. Listens to the traders, farmers and actual users, not people who came into the space to career farm off the latest Alt L1 raise.

Onboarding won’t happen by bringing a bunch of random consumers unto onchain apps, but where the technology, know-how and design solutions for underwriting user behavior become part-and-parcel of any consumer app in a zeitgeist of financial nihilism and uncertainty.

Disclaimer:

- This article is reprinted from [Lauris]. All copyrights belong to the original author [Lauris]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- The Gate Learn team does translations of the article into other languages. Copying, distributing, or plagiarizing the translated articles is prohibited unless mentioned.

Related Articles

12 Best Sites to Hunt Crypto Airdrops in 2025

Top 20 Crypto Airdrops in 2025

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

A Must-Try Project Backed by Binance Labs with Extra Staking Rewards (Step-by-Step Guide Included)

Gate Research: October Crypto Market Review