RWA Milestone: The First RWA Tokenized Stock Figure Is About to Launch

On August 5, the U.S. crypto capital markets welcomed an intriguing new entrant—Figure Technology Solutions (FTS). Founded by Mike Cagney, co-founder and former CEO of SoFi, this fintech firm filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC), officially initiating its IPO process. Unlike legacy financial institutions that follow conventional frameworks, Figure has integrated blockchain at its core from day one, using it to redefine the landscape of home equity and crypto-backed lending.

Mike Cagney, who previously sparked a fintech wave at SoFi, now aims to upend traditional banking models again with blockchain. “Our capital raise validates our vision to redefine capital markets through blockchain technology, and we’re already seeing the real benefits as blockchain transforms both our lending and capital markets businesses,” he stated.

Mortgage Innovation: America’s Largest Non-Bank HELOC Provider

In the mortgage market, Figure has directly targeted the pain points of traditional banks—speed and transparency. Previously, HELOC applications could drag on for weeks or months; now, on Figure’s platform, borrowers can apply entirely online, receive approval within as little as five minutes, and get funded in just five days.

To date, Figure has enabled more than 200,000 households to unlock $16 billion in home equity, propelling it to become one of the largest non-bank HELOC providers in the country. Remarkably, this achievement doesn’t come from “relaxed underwriting,” but rather from Figure’s proprietary blockchain, Provenance. Built on Cosmos SDK, Provenance operates as a public, PoS blockchain supporting instant finality—transactions are irreversible after confirmation, ensuring secure and transparent settlements.

Provenance establishes standardized, tamper-proof records for every loan on-chain and seamlessly connects with Figure’s own Figure Connect—a native on-chain private capital markets platform. This allows lenders and investors to match, price, and settle transactions entirely on-chain, reducing what was once a months-long process to mere days and redefining private credit transaction efficiency.

Crypto-Backed Loans: “HODL” Meets Liquidity

Having established itself in the mortgage sector through HELOCs, Figure is also gaining traction in digital assets with its crypto-backed loan products.

With this offering, clients can pledge Bitcoin (BTC) or Ethereum (ETH) as collateral and borrow up to 75% loan-to-value (LTV). Interest rates start as low as 8.91% (for 50% LTV), and there’s no need for a credit check.

All pledged assets are secured in decentralized, segregated multi-party computation (MPC) custody wallets. Clients can directly view the on-chain addresses, providing total assurance that assets can’t be misused. This means the assets can confidently “HODL” BTC or ETH for future gains, while the cash can be used for debt repayment, home purchases, renovations, or reinvestment in crypto.

This design is especially attractive in bull markets—investors unlock liquidity without selling, keeping upside potential. During downturns, they can tap into emergency funds via collateralized loans, and thus avoids forced liquidations.

Active Crypto Integration: RWA and Stablecoin Dual Engines

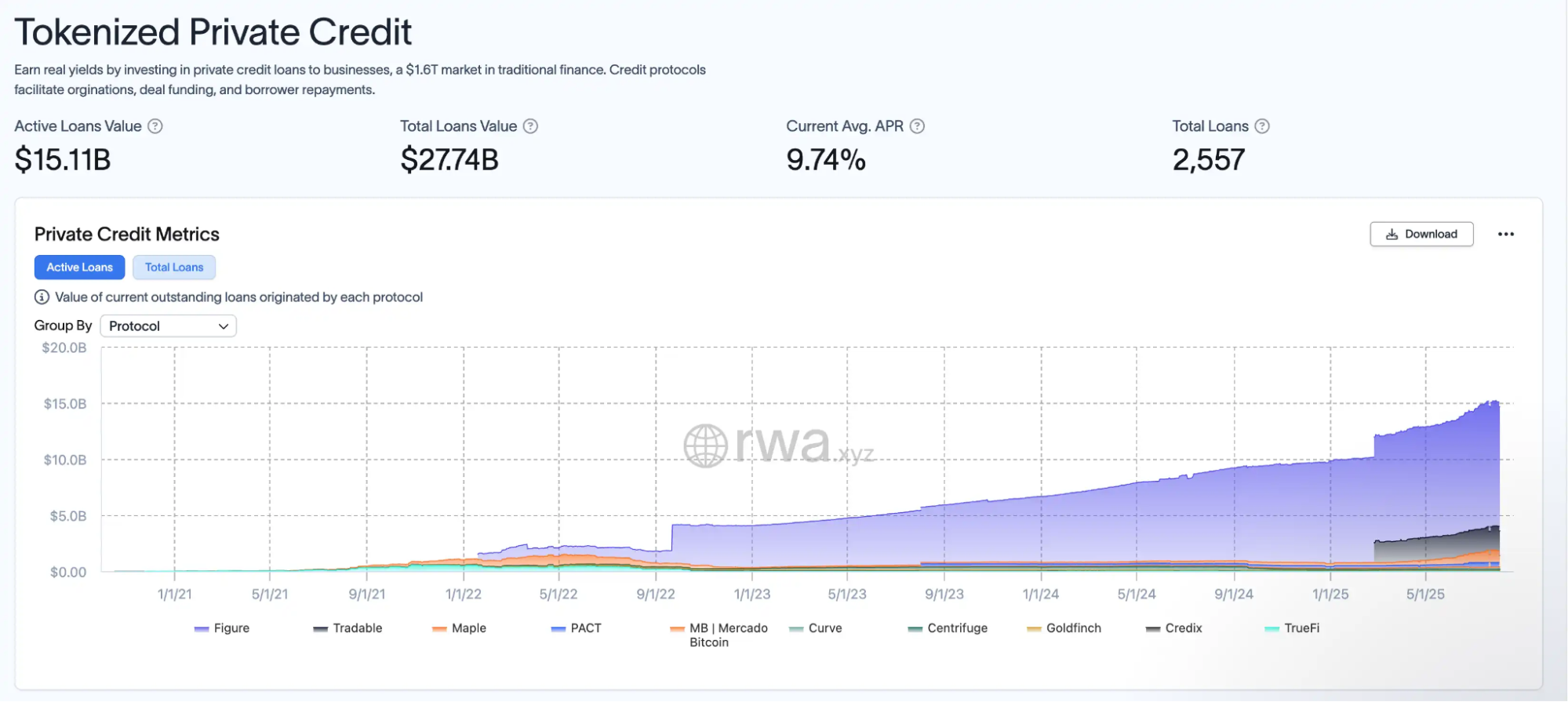

Figure’s ambitions stretch far beyond mortgages and crypto lending. Built on Provenance, Figure has originated a cumulative $13 billion in loans in the $27.74 billion tokenized private credit market, with $11 billion in active loans boasting over 84% utilization. As shown on rwa.xyz, Figure maintains the top spot in private credit. Whether it’s mortgage or private credit assets, Figure digitizes, programs, and standardizes their on-chain issuance and trading. These blockchain assets are naturally compatible with DeFi protocols, liberating capital formerly trapped in TradFi for global circulation, collateralization, and reuse—erasing the boundary between TradFi and DeFi.

Meanwhile, Figure Markets has launched YLDS—the world’s first SEC-approved interest-bearing stablecoin—pegged 1:1 to the U.S. dollar and earning interest at SOFR minus 50 basis points, with an annual yield of approximately 3.79%. YLDS is fully compliant and delivers stable returns, making it ideal for payments, cross-border settlements, collateralized financing, and more. The “RWA + stablecoin” model gives Figure exposure to both real-world and digital asset markets and positions it for the next multi-trillion-dollar boom.

Capital Strategy and IPO Preparation

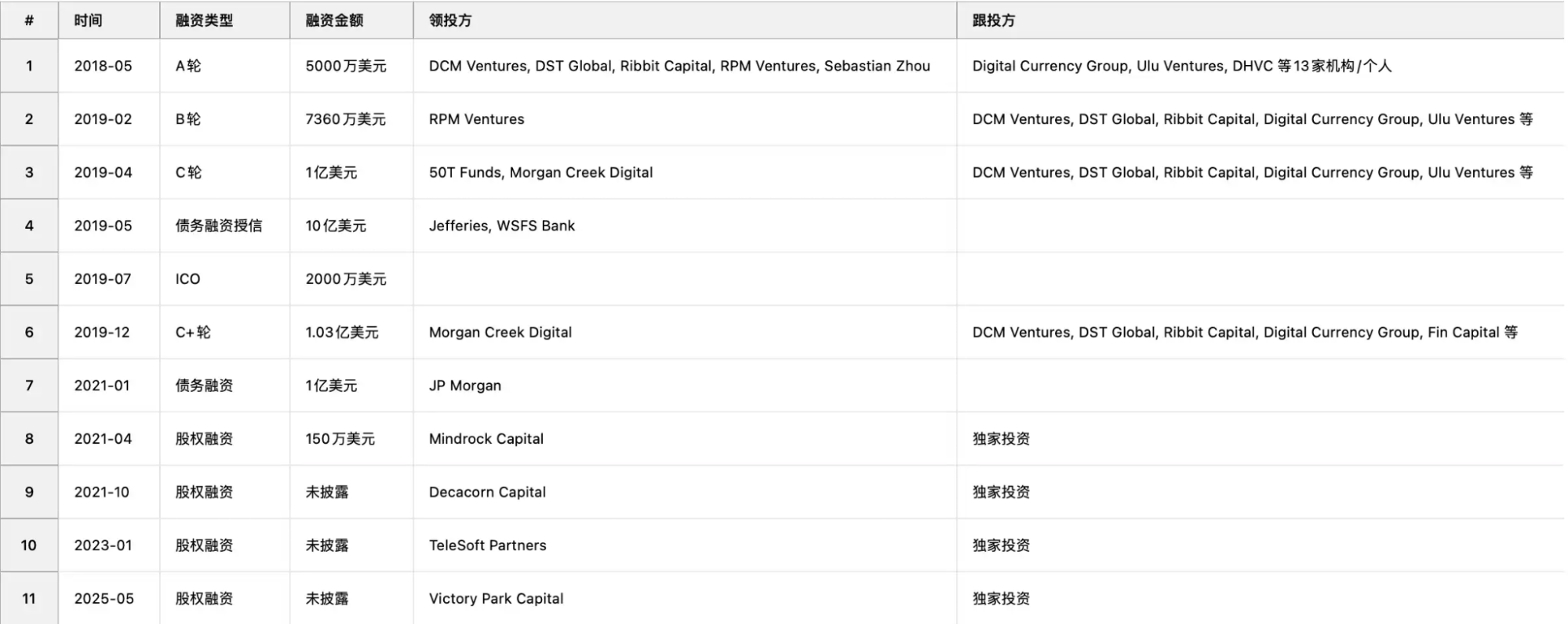

In just a few years, Figure has closed multiple funding rounds from premier investors such as DCM Ventures, DST Global, Ribbit Capital, and Morgan Creek Digital, as well as securing multi-billion-dollar credit lines from Jefferies, JPMorgan, and more. According to market reports, the IPO underwriting syndicate includes Wall Street giants like Goldman Sachs and JPMorgan.

Figure has also restructured its organization, bringing Figure Lending LLC under the Figure Technology Solutions umbrella and recruiting a senior executive team with extensive regulatory and corporate governance experience—preparing for a successful listing.

Summary

2025 may be recognized as the first true year of “crypto equities.” From the rapid rise of “altcoin MicroStrategy” plays, to CRCL’s legendary 10x growth just one month after its IPO, and as leading crypto firms like Kraken prepare for public listings, the convergence of traditional and on-chain capital markets is accelerating.

The industry is seeking a leading RWA platform—one capable of bringing trillions in real-world assets on-chain and redefining the market structure the way Bitcoin and Ethereum did. Figure is racing toward that distinction, and its next move may represent a significant development in financial history.

Disclaimer:

- This article is reprinted from [BLOCKBEATS], with copyright belonging to the original author [kkk]. If you have any concerns about this reprint, please contact the Gate Learn team. The team will handle your request promptly according to established procedures.

- Disclaimer: The opinions and viewpoints expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be reproduced, distributed, or copied without express mention of Gate.

Related Articles

Reshaping Web3 Community Reward Models with RWA Yields

ONDO, a Project Favored by BlackRock

Real World Assets - All assets will move on-chain

Gate Research: Understanding the Core Logic and Hot Projects of RWA in One Article

What Are Crypto Narratives? Top Narratives for 2025 (UPDATED)