Gate Research: Ethereum dApps Generate Nearly $26.8 Billion in Revenue | Gate’s Derivatives Volume Up 46.5% MoM in July

Summary

- Altcoins experienced a slow decline this week, with the median drop among the top 100 cryptocurrencies at 6.07%.

- Circle partnered with Corpay to provide stablecoin support for corporate transaction payments.

- PancakeSwap launched perpetual contracts for U.S. stock equities.

- Ethereum dApps have generated nearly $26.8 billion in cumulative revenue, with daily transactions nearing an all-time high.

- Gate’s derivatives trading volume rose 46.5% month-over-month in July, with market share increasing to 11%.

- Pump.fun launched 13,690 new tokens in the past 24 hours, surpassing LetsBonk in issuance but slightly trailing in daily trading volume.

Market Overview

Market Commentary

- BTC — Bitcoin declined 2.93% this week, outperforming altcoins. After dropping from around $117,833 to a low of $112,555, BTC saw a slight rebound to approximately $114,755. Market sentiment was influenced by macroeconomic uncertainties and ETF capital flows. BTC may continue consolidating in the $113,000–$116,000 range in the short term. A breakout above $116,230 could open the way for a push toward $120,000.

- ETH — ETH fell 4.53% this week, dropping from around $3,697 to $3,393 before rebounding to $3,719 on August 4. As of August 7, ETH had pulled back to $3,661. The MACD (12,26) sits at +15.48, indicating a bullish short-term momentum over the long-term trend. RSI (14) is at 58.41, in neutral territory, showing a stable market sentiment without overbought or oversold signals.

- Altcoins — Altcoins showed a slow, steady decline this week, with the median drop among the top 100 cryptocurrencies reaching 6.07%. Over the past seven days, MemeCore led gains with a 61.08% increase, while Pi saw the largest loss, falling over 18%.

- ETFs & Derivatives — ETFs saw net outflows exceeding $100 million for both BTC and ETH multiple times this week, reflecting growing institutional caution amid current market conditions. In the derivatives market, $22.29 million and $59.95 million worth of BTC and ETH positions, respectively, were liquidated in the past 24 hours.

- Macro Data — On August 5, the U.S. S&P Global Services PMI final reading for July came in at 55.7, beating expectations of 55.2 and up from June’s 52.9. This marked the fastest expansion since early 2025, indicating continued resilience in the U.S. services sector despite inflationary pressures and global trade tensions. Business activity, new orders, and employment all showed improvement.

- Stablecoins — The total market cap of stablecoins rose to $279.1 billion, suggesting a notable inflow of off-exchange capital.

- Gas Fees — Ethereum network gas fees decreased this week. As of August 7, the average gas price was 0.28 Gwei.

Trending Sectors

This week, the cryptocurrency market experienced a volatile downtrend, with a notable decline in investor optimism. Several altcoin sectors trended downward. According to Coingecko data, only a few categories—Launchpad, Derivatives, and Payment Solution—saw gained over the past 7 days, rising by 11.7%, 10.5%, and 4.4% respectively.

Launchpad

Launchpads are specialized platforms within the crypto ecosystem that serve as launch venues for new blockchain projects. They act as a bridge between early-stage projects with potential and investors seeking early access. Key functions include fundraising, token distribution, community building, and technical support. Eligible users can participate in token sales before public listing, providing exposure to high-growth opportunities. Launchpads are foundational infrastructure for innovation and incubation. — Over the past 7 days, the Launchpad sector rose 11.7%, with Omni Launch and Pump.fun gaining 36.1% and 23.8%, respectively.

Derivatives

Crypto derivatives are financial instruments whose value is derived from underlying assets like Bitcoin, Ethereum, or Dogecoin. They include futures, options, and perpetual contracts—allowing traders to speculate on price movements without owning the assets. This enables profit from volatility while also offering hedging tools to manage risk. However, due to their complexity and leverage, derivatives remain high-risk instruments, not suitable for all investors. — The Derivatives sector grew 10.5% in the last 7 days, with ZEX and ADX gaining 24.6% and 24.1%, respectively.

Payment Solution

The Payment Solution sector leverages blockchain to provide faster, cheaper, borderless, and more accessible alternatives to traditional payment systems. These solutions remove intermediaries like banks through peer-to-peer transactions, significantly reducing the cost and time of cross-border payments. Smart contracts enable automation, while stablecoins mitigate crypto price volatility—making blockchain payments programmable, transparent, and efficient. This is transforming e-commerce, remittances, and DeFi interactions. — Over the past 7 days, the sector rose 4.4%, with SWOP and KIN increasing 10.3% and 8.8%, respectively.

Focus of the Week

Cosmos Health Secures Up to $300M Securities Purchase Deal to Launch ETH Treasury

Nasdaq-listed Cosmos Health has entered a securities purchase agreement worth up to $300 million with a U.S. institutional investor to kick off its Ethereum treasury strategy. ETH assets will be custody-managed and staked through BitGo Trust Company’s institutional infrastructure. This move highlights the increasing interest of traditional public companies in digital assets. By employing institutional-grade custody and staking, Cosmos Health demonstrates prudent risk and compliance management. The move could optimize corporate treasury strategies and appeal to next-gen investors. Looking ahead, this initiative may contribute to Ethereum ecosystem growth and encourage broader corporate adoption—though regulatory risks and market volatility remain concerns.

Circle Partners with Corpay to Power Stablecoin-Based Corporate Transactions

Enterprise payment provider Corpay has partnered with global fintech firm Circle Internet Group to integrate USDC into its global payment rails. This enables corporations to fund cross-border transactions using USDC. The partnership represents a major step in merging traditional finance with blockchain, aiming to increase efficiency and reduce costs. It signals growing momentum for stablecoins in enterprise use cases, although regulatory uncertainty and adoption barriers remain. This development could help pave the way for broader use of digital finance globally.

PancakeSwap Launches U.S. Stock Perpetual Contracts

PancakeSwap has announced the launch of perpetual contracts for U.S. equities, starting with AMZN and TSLA, offering up to 25x leverage via its non-custodial Perpetuals platform. By introducing leveraged equity derivatives, PancakeSwap enhances its product appeal for crypto users seeking diversified exposure. This innovation may also attract traditional investors into the DeFi space, further blending decentralized and traditional finance.

Key Market Data Highlights

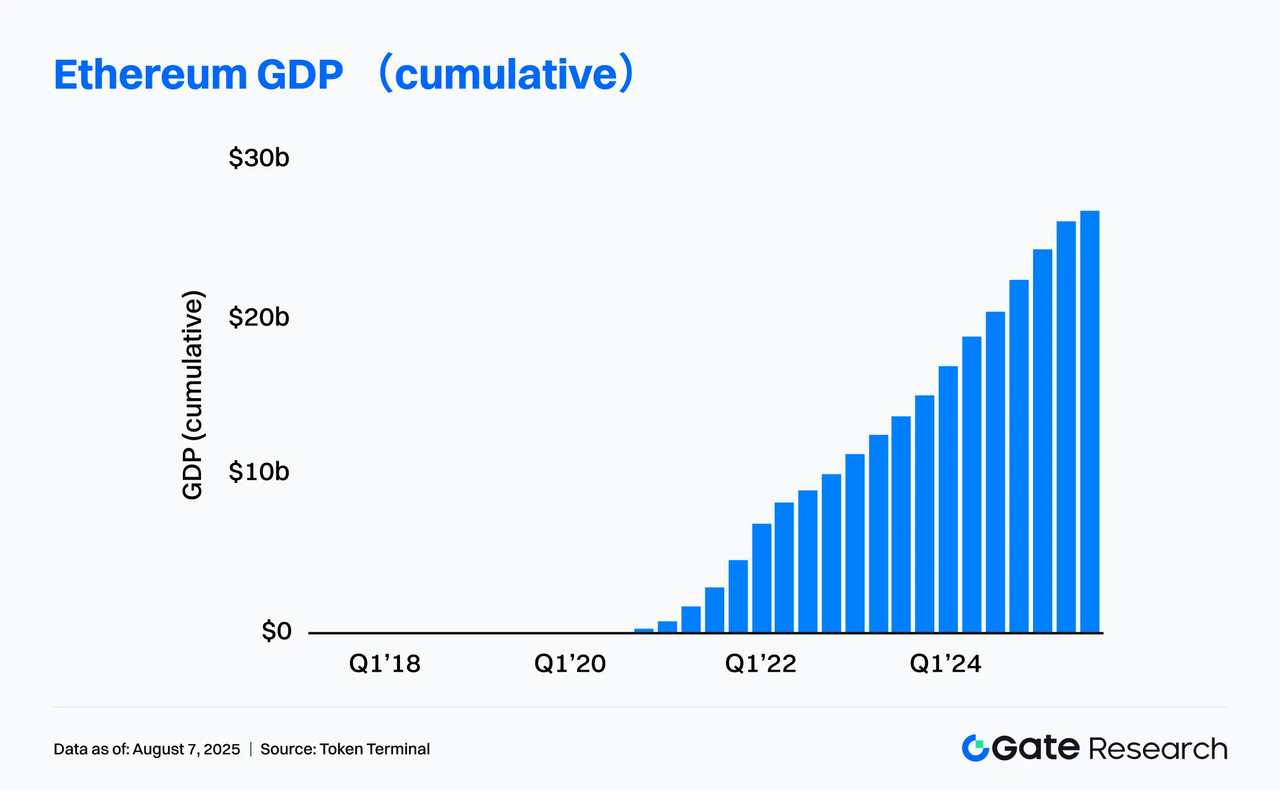

Ethereum dApps Generate Nearly $26.8 Billion in Revenue, Daily Transactions Near Record High

According to Token Terminal, since the launch of Ethereum’s mainnet, decentralized applications (dApps) on the network have collectively generated approximately $26.8 billion in user-paid fees. This figure is twice the market cap of the trending token HYPE, underscoring Ethereum’s unparalleled value capture in the Web3 application ecosystem.

On-chain activity is also surging. Etherscan data shows that on August 6, 2025, the number of daily transactions on Ethereum climbed to 1.87 million, approaching the all-time high of 1.96 million set on January 14, 2024. This spike is largely driven by the growing transaction volumes of USDC, Tether, and Uniswap.

Regulatory developments may be a key catalyst. The recently passed and signed GENIUS Act in the U.S. provides a clear legal framework for the compliant operation of stablecoins, boosting market confidence and contributing to increased activity in stablecoin-related transactions.

Gate’s July Derivatives Volume Surges 46.5%, Market Share Hits 11%

According to CryptoRank, centralized exchange Gate recorded a derivatives trading volume of $740 billion in July 2025, marking a 46.5% month-over-month increase—the strongest growth among major CEXs. Simultaneously, Gate’s derivatives market share rose to 11%, setting a new yearly high and further solidifying its competitive position in the global derivatives landscape.

As overall CEX activity rebounded in July, Gate stood out with the highest increase in derivatives volume. This growth reflects initial success from its product, user, and strategy optimizations. The platform continuously introduced new token contracts across trending sectors such as AI, L2s, and RWAs. Additionally, enhancements to its VIP tier system and market-making incentives have improved high-frequency user retention. Volatile market conditions in July also created opportunities for leveraged trading.

Meanwhile, ongoing infrastructure upgrades—including improvements in stablecoin deposit/withdrawal efficiency, API performance, and the matching engine—have further enhanced the trading experience and capital efficiency, contributing to sustained volume growth.

Pump.fun Launches 13,690 New Tokens in 24 Hours, Surpasses LetsBonk but Slightly Trails in Volume

According to Dune Analytics, the competition between Pump.fun and LetsBonk, two major memecoin launch platforms in the Solana ecosystem, remains intense. Over the past 24 hours, Pump.fun launched 13,690 new tokens, narrowly surpassing LetsBonk’s 13,392, signaling growing momentum in attracting new projects and increasing platform activity.

However, in terms of trading volume, Pump.fun still trails slightly, recording $82.4 million, compared to LetsBonk’s $87.7 million. Despite this, PUMP token has seen a 17.8% price increase over the past week, reflecting a modest rebound and positive market sentiment regarding platform growth potential.

Overall, Pump.fun has taken a lead in token issuance, and if it can improve trading depth and user retention, it may soon close the volume gap and further strengthen its position in the on-chain memecoin launch sector.

Funding Weekly Recap

According to RootData, between August 1 and August 7, 2025, a total of 12 crypto projects announced funding rounds or acquisitions. These span multiple sectors including infrastructure and AI, reflecting continued investor focus on foundational technologies and user applications. Here are the top three funding rounds this week:

Satsuma Technology

On August 6,it raised $217.6 million, including $125 million settled in Bitcoin, to advance its decentralized AI and Bitcoin treasury strategy.

Formerly known as Tao Alpha and publicly listed under SATS.L, Satsuma is building infrastructure and agents on Bittensor, investing in high-potential subnets, and developing revenue-generating AI agents.

OpenMind

On August 4, secured $20 million, led by Pantera Capital with participation from Coinbase Ventures and others.

OpenMind is building a decentralized AI framework for intelligent, secure, and controllable robotics, including a cross-platform operating system called OM1.

Rialo (Subzero Labs)

On August 2, Subzero Labs raised $20 million in a seed round to develop Rialo, a next-gen blockchain network.

Rialo is a decentralized, high-performance, ergonomic blockchain with a super-modular design aimed at simplifying blockchain application development, and is compatible with Solana VM.

Next Week to Watch

Token Unlocks

According to Tokenomist, several major token unlocks are expected in the coming week (Aug 8–14, 2025). The top 3 are:

- APT: $47.95 million worth of unlocked tokens, accounting for 1.7% of total locked supply.

- LAYER: $16.21 million worth unlocking, or 12.9% of total locked supply.

- IMX: $12.63 million worth unlocking, or 1.3% of circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Gate, https://www.gate.com/trade/ETH_USDT

- Coinmarketcap, https://coinmarketcap.com/

- Farside Investors, https://farside.co.uk/btc/

- Coinglass, https://www.coinglass.com/LiquidationData

- S&P, https://www.pmi.spglobal.com/Public/Home/PressRelease/3b4c09ac68ec4b03a5fcd98f1e0f3b98

- Coinmarketcap, https://coinmarketcap.com/view/stablecoin/

- etherscan, https://etherscan.io/gastracker

- Coingecko, https://www.coingecko.com/en/categories

- Globenewswire, https://www.globenewswire.com/news-release/2025/08/06/3128410/0/en/Cosmos-Health-Secures-up-to-300-Million-Financing-Facility-to-Launch-Ethereum-Treasury-Strategy.html

- Corpay, https://investor.corpay.com/news-releases/news-release-details/corpay-and-circle-collaborate-bring-stablecoin-payments-global

- PancakeSwap, https://blog.pancakeswap.finance/articles/stock-perps

- X, https://x.com/TheDeFinvestor/status/1953019296570802395

- X, https://x.com/CryptoRank_io/status/1952758064634888626

- Dune, https://dune.com/adam_tehc/memecoin-wars

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?

What Is Technical Analysis?

What Is Fundamental Analysis?